In fact, the stock has never challenged its all-time highs and is down roughly 4% since its 2018 debut. The stock ran higher to an all-time high of around $40 per share within a few months of its public debut but has since lost all momentum. Many people that aren’t familiar with the company will certainly recognise its blue logo.ĭropbox became a public company in early 2018 at $29 per share.

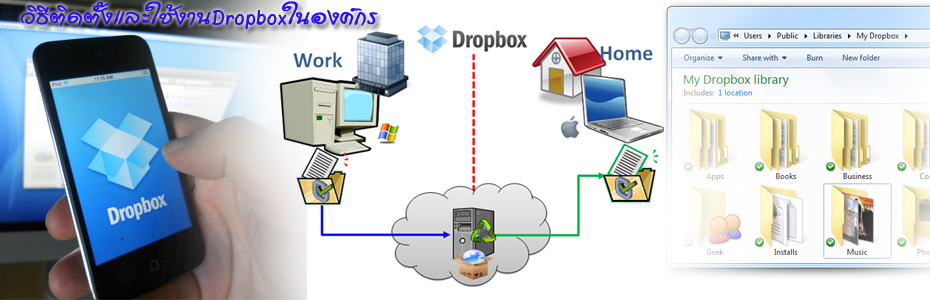

Dropbox operates on the cloud, which makes a user’s files accessible online from anywhere, at any time, and on any device. Read more: Crowdstrike (CRWD) stock forecast 2021-2025: strong earnings make it a top growth stock pickĭropbox (DBX) is a technology company that helps individuals and businesses securely store and share files with each other.Dropbox (DBX) stock forecast for 2021-2025: encouraging long-term strategy.During the past 12 months, Dropbox's ROIC is 5.45 while its WACC came in at 6.40.US30 US Wall Street 30 (USA 30, Dow Jones) If the return on invested capital exceeds the weighted average cost of capital, the company is likely creating value for its shareholders.

The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets.

Return on invested capital (ROIC) measures how well a company generates cash flow relative to the capital it has invested in its business. One can also evaluate a company's profitability by comparing its return on invested capital (ROIC) to its weighted average cost of capital (WACC). The 3-year average EBITDA growth rate is 57.6%, which ranks better than 91% of the companies in Software industry. The 3-year average annual revenue growth rate of Dropbox is 17.9%, which ranks better than 76% of the companies in Software industry. The faster a company is growing, the more likely it is to be creating value for shareholders, especially if the growth is profitable. GuruFocus research has found that growth is closely correlated with the long term performance of a company's stock. Growth is probably the most important factor in the valuation of a company. Dropbox Stock Gives Every Indication Of Being Fairly Valued

0 kommentar(er)

0 kommentar(er)